Your cart is currently empty!

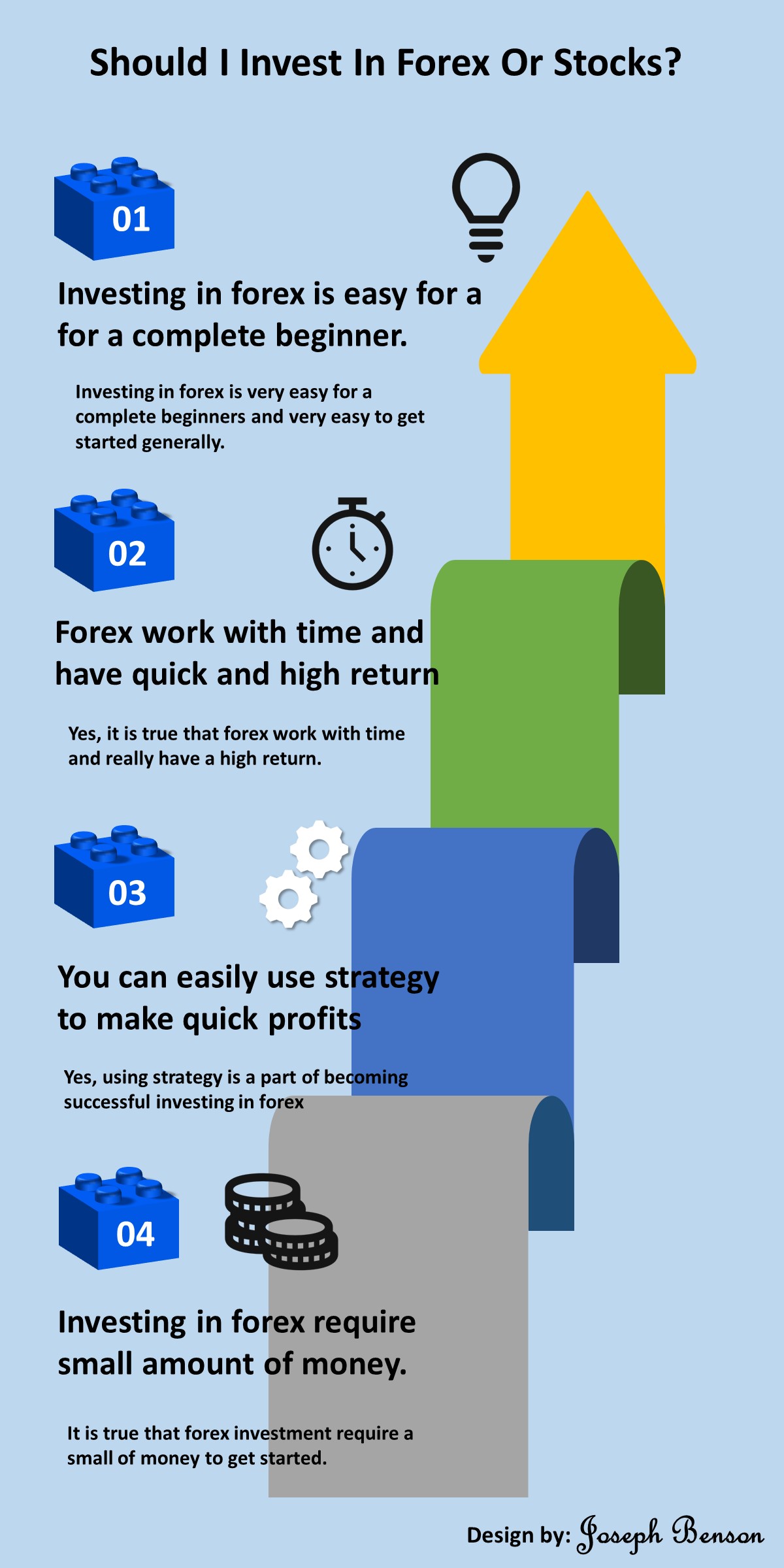

Should I Invest In Forex Or Stocks? (Top 5 Secret on Stock, Forex Trade)

Affiliate Disclaimer: This post may contain affiliate link or links

Should I invest in forex or stocks? You should invest in forex because it’s easier for a complete beginner and cheap to get started. Forex trading is easier to get started since you can start with a small capital and use leverage. Invest in forex straight up.

The truth is that there are many options to choose from, and if you are a beginner, they can be overwhelming. The fact is that most people who ask themselves this question have no idea what it takes to invest in the financial markets or to start trading generally.

If you are a complete beginner in the world of financial market, I recommend that you start with forex trading because it is inexpensive to begin and very beginner friendly. In the long run, both stock and foreign exchange may provide us with good returns.

They are somewhat different from each other. So, it is hard to give a general answer to this question about whether one should invest in stocks or forex

Should I invest in forex or stocks?

Forex and stocks are both forms of investment. The main difference is that forex involves trading currencies, while stock involve buying shares in a companies.

This book will be of great help. Both types of financing have advantages and disadvantages, but the main question is whether you should invest in either of them at all.

Before deciding which one to choose, you should consider whether it suits your needs better. If you’re a beginner or don’t have much experience with financial markets.

Then stocks might be more suitable for you. If you’re looking for long-term profits and want to diversify your portfolio, then forex could be a good choice.

stock are investments in companies that allow you to become a part-owner of a business. You can purchase stock through your broker or directly from a company.

The advantage of buying stocks is that you can diversify your portfolio. If one companies fails, it will not affect your entire financing portfolio because you own many different stocks.

The disadvantage of buying stock is that they are more volatile than other types of financing, such as bonds and mutual funds. This means that there is more risk involved with owning stock compared to other types of investments like bonds or mutual funds.

When trading FX, you are not funding in a company but rather the value of one currency against another (or multiple currencies). The value changes based on supply and demand in the market at any given time.

Read more articles: Can Forex Trading be a Business?

Benefits of trading Forex

The Forex market is the largest and most liquid market in the world. It runs 24 hours a day, 5 days a week, and has a minimum deposit of only $250 depending on the broker. This makes it accessible to everyone, including small traders with limited capital to trade foreign currency.

In addition to being accessible to everyone, the Forex market provides traders with numerous benefits: Bigger potential gains compared to other markets. The Forex market offers many opportunities for traders to make huge profits in relatively short periods of time.

The recent upward trend in the value of Bitcoin proves this point perfectly if you had invested $100 into Bitcoin at its launch in 2009, your investment would have been worth over $10 million by 2013!

Low investment costs

Trading on margin allows you to trade with much more money than you actually have available in your account but without having to pay interest on any borrowed funds as long as you maintain a certain amount of equity in your account.

This means that even if you only have $100 available for trading, it’s possible for you to enter positions worth thousands or even millions of dollars depending on how much margin is available on your account

Flexibility. Forex traders can trade from anywhere in the world, 24 hours a day.

High returns. The forex market is open all year round, which means that you can trade it around the clock. This provides you with greater opportunities to profit from fluctuations in currency prices.

Low risk. Foreign exchange traders only need to use small amounts of capital when trading, so there is less risk involved than in trading shares or commodities.

For example, if you want to trade $1 million worth of dollars against euros, then you will only need $100 000 in your account (the other $900 000 will be held by your broker).

Freedom from restrictions and regulations. You don’t need any special qualifications or licenses to trade forex just an internet connection and a computer or mobile phone with internet access so it’s easy for anyone to get started!

Read more articles: Fx Swap and Currency Swap Difference

Top pick

Editor’s choice

Best value

Benefits of trading assets

Trading stocks is a rewarding and exciting way to make money. The stock market is a place where investors can buy and sell shares of companies unlike forex you will be trading on currency or different currency.

In order to trade assets, you’ll need to open an account at a broker and fund it with money. A broker acts as an agent between buyers and sellers

One benefit of trading assets is the ability to make money quickly and easily by buying low and selling high. For example, if you bought 100 shares of company XYZ at $10 per share, your initial financing would be $1,000 ($10 x 100).

If company XYZ later rose to $20 per share and you sold all 100 shares for $2,000 ($20 x 100), then your profit would be $1,000 ($2,000 – $1,000).

This is known as short-term trading or day trading because you’re only funding in stocks for a few days or weeks before selling them back again at a higher price.

Another benefit of trading stocks is that it’s relatively easy to learn how to do it properly especially if you have some basic knowledge of finance and accounting.

Many online courses are available that teach people how to use real-time data feeds from exchanges such as New York Stock Exchange (NYSE) and NASDAQ, which will allow them to stay on top of the latest developments in their favorite companies.

Another benefit of trading assets is that there are no limits on how much money an individual trader or traders can make or lose that is the good news.

There are no restrictions on what kind of trades an individual trader can make or how much capital he or she can trade with as long as he or she has enough money in his account to cover the potential loss from a trade gone bad.

Read more articles: How do I Start a Forex Brokerage

Easy ways to trade stocks

Trading stocks has become simpler than ever, thanks to the advent of technology. One of the simplest ways to get started is to open an account with an online broker. There are many reputable platforms that offer a user-friendly interface, low fees, and a wide range of financing options.

Another option is to invest in a low-cost exchange-traded fund (ETF) that tracks a market index, such as the S&P 500. This is a passive investment strategy that requires little maintenance and provides exposure to a diverse range of stocks.

If you want to actively trade assets, it is important to do your research and understand the market, as well as to have a solid financing plan in place. Remember, trading assets always involves some risk, so it’s important to proceed with caution.

Trading stocks for beginners

Trading stocks can be a great way to grow your wealth over time, but it can also be overwhelming for beginners. The first step is to educate yourself on the stock market and become familiar with terms like stocks, bonds, and mutual funds.

It is also important to choose a reputable broker, such as Robinhood or E-Trade, to execute trades. Setting a solid investment strategy and having a diverse portfolio can help mitigate risk.

Additionally, stay up to date with financial news, and don’t let emotions guide your decision-making. Remember, successful stock trading takes time, patience, and practice.

Start small, do your research, and don’t be afraid to ask for help from a financial advisor about how to succeed in stock trading.

Understanding stock market

The stock market or stock trading can be a confusing and intimidating place for those who are new to investing. However, with a basic understanding of how it works, anyone can participate in the buying and selling of stocks.

The stock market is a platform where publicly traded companies offer shares of ownership in exchange for investment capital. When you buy stock, you own a piece of the company and are entitled to a portion of its profits and voting rights.

The stock’s price is determined by supply and demand in the market and can fluctuate based on a variety of factors, such as the companies financial performance and market conditions. By funding in the stock market, individuals can grow their wealth over time and achieve their financial goals.

Understand the market trading secrets

The world of trading can be overwhelming, with an abundance of information and terminology to learn. However, understanding the basics of market trading is essential for anyone looking to invest their money.

One of the most important secrets of the market is understanding supply and demand. When demand for a particular stock or commodity increases, its price rises, and when demand decreases, its price drops.

Another important factor to consider is market sentiment, which refers to the overall psychological and emotional state of market participants.

Additionally, keeping up with the latest news and events, such as economic data releases, can give you a better understanding of market trends and help you make informed trading decisions. By keeping these secrets in mind, you can increase your chances of success on the market.

Stock investment is less risky than FX

The stock market is a great way to make money, but it is also very risky. The value of stocks can go up and down like a roller coaster, so it is important that investors know what they are doing before jumping into the market. Honestly forex is generally riskier.

There are many reasons why stock investment is less risky than forex trading. Some of these reasons include:

1. You don’t have to worry about currency fluctuations if you invest in stocks.

2. You don’t have to worry about the political situation of your country if you invest in stocks.

3. You don’t have to worry about currency conversion fees or charges if you invest in stocks.

Putting your money in stocks is not necessarily less risky than funding in forex . It all depends on the type of stocks you invest in, and how well you understand the risks involved.

Of course, there are a lot of risks involved with forex trading. You have to take into account the risk of exchange rates, the risk of losing money and the risk of not being able to withdraw your funds.

As for stock investments, there are no such risks involved because you will own a part of the company and will receive dividends from its profits.

The risk of loss in trading shares can be reduced by diversifying your portfolio of stocks across different industries, countries or sectors. The risk of loss in trading FX can be reduced by diversifying your portfolio across different currencies and by using stop-loss orders.

In contrast to the stock market, the forex market has no centralized exchange where shares are traded. This means that you cannot use stop-loss orders on your forex positions because there is no limit order book on which to place such an order.

It also means that there is no centralized clearing house through which all forex transactions must pass before being settled. There is therefore no guarantee that your trade will be settled at all when you buy or sell a currency pair through an online broker

Top pick

Editor’s choice

Best value

Forex trading has better average returns

Trading in the forex market is a highly speculative activity. There is a high degree of leverage involved, and losses can exceed deposits.

You should be aware of the risks associated with trading and seek advice from an independent financial advisor if you do not understand the risks involved.

Fx trading has better average returns

If you trade in forex, you can earn some pretty good profits. The average return on investments over the past 20 years has been about 4%.

This means that if you made $100,000 in profits on average per year, it would take 100 years to double your money!

This may seem like a long time but it’s actually quite quick compared to many other investments. For example, gold has an average annual return of only 0.3% while stocks give an average return of 6%.

Forex is the largest and most liquid market in the world. The Forex market has about $10 trillion worth of currency traded on a daily basis.

This is compared to $1.5 trillion for the U.S. stock market and $1.7 trillion for the U.S. bond market, according to statistics from the Bank for International Settlements (BIS).

The average return of foreign exchange is around 2 percent per year, according to research by Mark J. Hulbert, editor of The Hulbert Financial Digest

Who analyzed data from 1990-2002 and found that forex trading was one of the best investments over that period. However, this figure is likely to be higher today because of increased volatility on forex markets since 2002.

The average annual return for stocks was 9 percent during this period and 3 percent for bonds which means that foreign exchange traders would have outperformed both stocks and bonds if they invested in these markets alone instead of diversifying their portfolios across asset classes.

Read more articles: Forex Trading Basics Rules

Pros of FX trading

There is no doubt that forex trading has become a popular investment option for people from all walks of life. It is true that forex trading can be complex, but it is also one of the most profitable investment opportunities available.

In fact, if you know what you are doing and if you have the right guidance and tools, then you can make a lot of money through forex trading. Here are some pros of forex trading:

Trading in forex allows you to speculate on the value of currencies against each other. You do not need to buy any stocks or bonds. All you need is an internet connection and a computer system or mobile phone and you can trade in Forex 24 hours a day 7 days a week.

This gives you more flexibility than other forms of investment such as stocks or bonds, which only trade during specific times during the day (usually 9 a.m.–4 p.m.).

You do not need much money to start investing in forex trading. You can start with as little as $100 and still make money from your investment!

This means that almost anyone can participate in this form of investing even if they don’t have much money to spare out of their budget for funding purposes.

Read more articles: Download Forex Profit Supreme

Top pick

Editor’s choice

Best value

Pros of assets trading

1. The stock market is the largest and most liquid market in the world.

2. The stock market provides investors with a low-cost, efficient way to buy and sell securities.

3. Stocks can be bought and sold at any time during the trading day at fair market prices.

4. Stock prices reflect a company’s performance over time and price fluctuations provide information about changes in supply and demand for its shares.

5. Trading stocks gives you an opportunity to diversify your investment portfolio by adding a new asset class or industry sector to your portfolio.

6. With stocks being traded on public exchanges, investors do not need to know about share valuation methods or how to estimate future cash flows from a company in order to invest successfully in this asset class (unlike private companies)

Cons of forex trading

Trading FX on margin carries a high level of risk and can result in losses that exceed your deposits. Before deciding to trade forex, please read the Risk Disclosure Statement.

Forex is highly speculative and leveraged products carry a high degree of risk to your capital. You should only speculate with money you can afford to lose, or at least be able to pay for if you lose all your capital.

The ability to profit from small price changes in currencies is limited compared to other markets, such as stocks or commodities. Therefore, it is not advisable for day traders or those who have a short time horizon (i.e., less than 1 year).

Cons of stocks trading

Stocks trading has its own drawbacks. The first one is the high volatility. It means that stocks can lose or gain a lot of money in just a few days. This is not suitable for those who want to save their money for the future and make it grow.

Another issue is that stocks don’t have any guarantees that they will be worth anything in the future, so they can lose all their value if there is a recession or something similar happens.

Finally, there are some people who don’t like trading assets because they find it too stressful due to its volatility and unpredictability.

Read more articles: Accounting for Foreign Exchange Swap

FAQ

1. Is forex better than assets?

Not really better but trading FX is very easy to start even for a complete beginners.

2. Should I learn to trade asset or forex?

3. Is forex worth investing?

Forex trading is risky and also profitable, of course it is worth funding your money but first learn the basic.

4. What are the risks of forex trading compared to stocks?

5. Which is riskier assets or FX?

Forex is more riskier than stocks.

6. Which one is easier to trade: FX or shares?

Forex is simpler to trade compare to stocks.

7. Is assets trading riskier that FX trading?

No! Forex is riskier compare to stocks trading.

Final conclusion

As we have discussed before there are many decision to make when choosing between any two investments. First you need to understand how forex and stock works.

What their respective advantages and disadvantages are. Then you need to figure out the amount that you can invest, evaluate your risk exposure and investment timeframe.

Moreover, with the amount of money that you decide to invest, you will also be deciding your profitability rate. The last thing which is related to your profit making ability is the amount of time that you have at hand.

As a trader, I consider myself fortunate to have come across two of the best investment mediums on the internet, with the Forex market representing one and the Stock market representing the other.

While both represent viable trading options and are certain to let you make some money, only one has proven over time to outsmart the market and will likely prove profitable in the long term:

The Forex market, while being an excellent source of revenue in the short term, is notorious for its short-term crashes.

Read more articles: Create Your Own Forex Robot

Download Forex Infinity Strategy Free

Start Your Forex Journey with Free $500 Reliable Broker

Download 100% Accurate 5 Bar Reversal

Other related articles

- Trade Report Indicator: Indicator for Forex Traders

- Trend Profiteer Trading System: A Trader’s Must Have

- Quantum Trend Sniper Indicator MT4: Free Download

- German Sniper Indicator: Unveiling its Power

- Mastering MACD Intraday Trend | Indicator Free Download

- Crazy Accurate 5-Days Breakout Strategy: Unlock Success

Joseph Benson, I have been trading forex for more than 15 years now and I am still trading actively, a content writer, an Architect also SEO expert, learn how to trade easily with me.

Leave a Reply